It is important to understand the main differences between an independent contractor worker vs employee when hiring new workers. The classification of a contractor worker vs employee has implications for their entitlements, for example health benefits, paid vacation and taxation. Misclassifying workers can have serious financial implications for your business. As a result, you should familiarize yourself with different types of workers, including:

- Employees.

- Statutory non-employees.

- Statutory employees.

- Independent contractors.

Comparing an independent contractor worker v. employee will equip your business to improve its hiring process and to comply with the rules and regulations set out by the IRS.

[Want more tips to improve your hiring process? Click here for seven fundamental tips to boost your hiring.]

What is an employee?

Employees are sometimes referred to as common law employees and are paid on an hourly, commission or salaried basis. Employees are normally entitled to receive overtime pay. Your business is required to withhold state and federal taxes from your employees’ wages. Federal Insurance Contributions Act (FICA) taxes, which include taxes for Medicare and Social Security must also be withheld from your employees’ pay. Employees must receive a Form W-2, which details the income they have earned during the year.

Typically, an employee can be classified by the amount of control your business has over their work. Where your business is in charge of the details around how tasks are completed, the person doing the work is likely to be an employee. Additionally, if your business buys supplies and has the final say on how payment is handled, it is highly likely that this worker will be classified as an employee.

The following are indications that a worker is an employee:

- Normally works for only one company.

- Works the hours that your business requires.

- Generally works at your place of business.

- In some cases will be entitled to employment benefits, for example health insurance.

- Carries out the job in a way that is dictated by your business.

- Typically, does not incur costs in relation to their work.

- Receives training from your business to improve their performance.

- Gets a net salary after your business has withheld the relevant taxes.

- Usually, will receive compensation if they are laid off or the employment is terminated.

- Entitled to get worker’s compensation in the event that they suffer an injury at your place of business.

- Eligible for protection in relation to overtime rules, minimum wage and other state and federal legislation.

- Permitted to join a union.

- Protected by anti-discrimination and laws relating to workplace safety.

Independent contractor worker

One of the main differences between an independent contractors worker vs employee is that independent contractors are free to work for different clients. Independent contractors are also known as contract workers and normally receive pay for every project, as opposed to hourly pay or a salary. They typically work in any location they choose and use their own resources to carry out projects.

If you hire a contract worker, your business does not withhold state, federal or FICA taxes on their pay. Independent contractors are responsible for paying their own self-employment tax.

A worker can be classified as an independent contractor if the following applies:

- Consults for multiple businesses.

- Controls the hours worked.

- Chooses where they work.

- Ineligible for employment benefits from your business.

- Works independently.

- Decides how they will complete the work.

- Incurs costs that are related to completing the work.

- Experts in a chosen field with the relevant qualifications and experience.

- Responsible for paying self-employment tax.

- Not entitled to workers’ or unemployment compensation benefits.

- Not eligible for overtime pay.

IRS guideline for independent contractor vs employee

The IRS does not provide a blanket method of classifying a contract worker vs employee. Typically, the IRS guidelines for independent contractor vs employee will make the assumption that a worker is an employee. Each situation will be looked at separately to decide whether a worker should be an independent contractor vs. an employee. However, you can use the following guidelines issued by the IRS to help you to categorize a worker:

- Financial control – This issue takes into account how your worker is paid, whether they can incur a profit or a loss while working for you and whether they are free to take up additional work with different companies. Therefore, if you pay a worker a salary with limitations on working for other companies and they do not take part in your business profits or losses, this person could be an employee according to the IRS.

- Behavioral Control – Where your business provides training, rules about how work should be performed and the type of tasks that need to be done, it is likely that you are dealing with an employee. Where someone works for you and receives no or very little training or direction from your business, it is almost certain that this person is a contract worker.

- The nature of the relationship – Being in possession of a specific type of contract could imply that a worker is an independent contractor. However, this cannot be taken in isolation when classifying a worker. For instance, if you provide the worker with benefits, this could mean that they have received employee status.

If you are having difficulty classifying employees vs. independent contractors, it is always safer to assume that the worker is an employee in relation to the IRS. You should file a Form SS-8 ‘Determination of Worker Status for Purposes of Federal Employment Taxes and Income Tax Withholding’ if you are unsure about whether someone is a contract worker. You will be notified by the IRS about how the worker should be classified. Form SS-8 can also be submitted to the IRS by your workers.

When you have identified someone as a contract worker, you are required to:

- Get a valid taxpayer ID number from the independent contractor. If your business does not receive a valid taxpayer ID, you must deduct backup withholding, from the contract worker’s payments. Backup withholding is a tax that must be withheld on certain types of income in relation to federal tax.

- Provide a 1099-MISC form if the independent contractor is paid more than $600 or more during a year. The 1099-MISC form is due at the end of January for the previous year.

Contract worker vs employee

Gig workers are generally considered to be independent contractors and must rely on the terms of a contract if they have a dispute with the company they work with. This is because they are not covered by the Fair Labor Standards Act.

Gig workers, who are also known as on-demand workers are part of the contingent workforce. This classification of worker generally does not have the rights to go to a government agency for assistance in relation to getting their contract enforced. In these circumstances, the contract worker would have to file a lawsuit if they believe your company has breached the contract.

[Click here for nine important things you should know about the gig economy.]

There have been labor advocates who have tried to reclassify gig workers as employees, ever since the emergence of on-demand work. This is due to the belief that on-demand workers receive no or little protection, while bearing the employer’s costs. In support of this point of view, a state Supreme Court ruling in California in April 2018 found that employers must use a narrower test when deciding how to classify workers. The decision resulted in a mandate for cannabis-delivery workers to be classified as employees. As a result, the indications are that an increasing number of companies may have to classify gig workers as employees.

Uber and other California-based companies may be subject to overtime and minimum-wage laws for gig workers in the future. It is estimated that a shift from the contract worker to the employee model could cost companies an additional 20 to 30%.The Supreme Court ruling has implications for the classification of workers and can make it harder to categorize workers as independent contractors.

The test applied by the Supreme Court in California to determine a worker’s status was much simpler than previous tests. Instead of applying numerous different factors to determine whether someone is an employee, the court used the test of whether the worker performs a job that is part of the usual course of the company’s business. If it is found that a worker can answer yes to this test, they will be considered to be an employee and not a contract worker. Additionally, a company needs to demonstrate that it does not direct the worker and the worker actually operates their business in an independent way.

The independent contract worker vs employee debate continues in relation to on-demand workers. It is advisable to seek legal advice when hiring gig workers. It is generally accepted that gig workers fall under the category of contract workers. However, the ruling by the Supreme Court in California could mean that there is a change in this area.

The importance of classifying workers correctly: Contract worker vs Employee

Being clear on the differences between contract worker vs employee can save your business from paying financial penalties. Misclassifying workers may result in your business being ordered to pay the worker’s employment taxes. If a contract worker claims that they should be an employee, you can appeal with a counterclaim and show evidence that your business relationship does not constitute that of an employer and employee.

You must try to stick to all the legal requirements when classifying a worker as an independent contractor. In order to satisfy as many of the contract worker requirements as possible, it is advisable to show that the work that is carried out is independent of your business.

Since there are tax implications when classifying workers and independent contractors, misclassification can mean that your company will be responsible for paying back taxes.

Should your company classify an employee as a contract worker, the worker has the right to bring an unemployment claim against your business after their contract has expired. This could result in your company being fined thousands of dollars by the Department of Labor.

Where a company classifies workers as independent contractors intentionally or fraudulently, they can face a fine of up to hundreds of thousands of dollars. The case of Norwood Commercial Contractors Inc. demonstrates the penalties that can be given for misclassifying workers. The company was ordered to pay nearly $400,000 for misclassifying some workers and failing to pay other employees for the hours they worked.

Different industries have distinct rules and regulations in terms of employee classification. For example, the healthcare industry is heavily regulated, so extra care needs to be taken when determining whether someone is a contract worker.

The guidelines above should help you when deciding whether a worker is an employee vs. an independent contractor. Although there is some ambiguity around the classification of workers, this type of uncertainty should not be part of other elements of your hiring process.

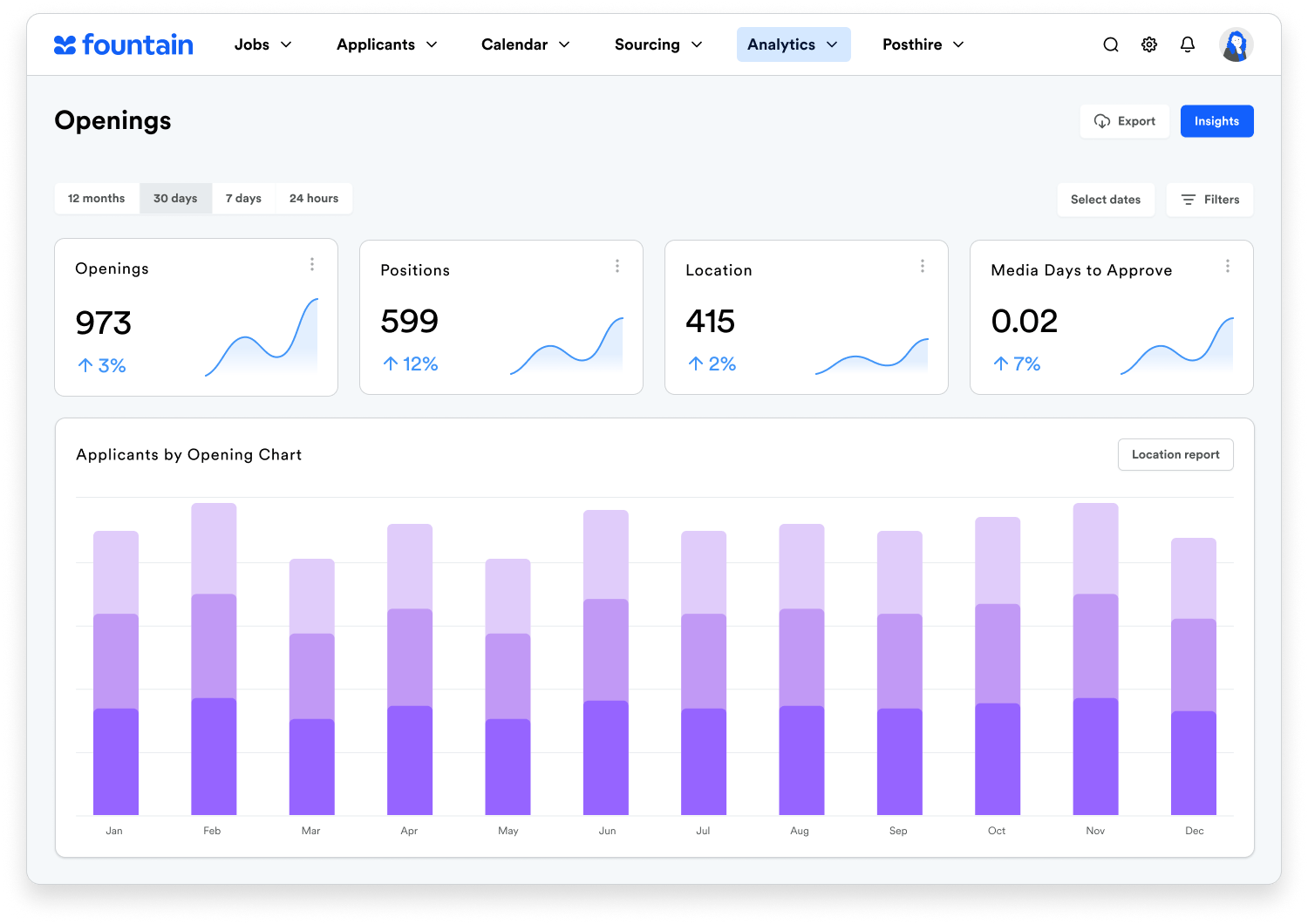

With Fountain, you can reduce the uncertainty associated with hiring workers. Whether you need to hire 10 or 1,000 workers, for a single business or a franchise, our platform gives you and your candidates a clear, seamless and consistent experience.